The Pound to Rand exchange rate has fallen from its seven-year highs and analysts expect it to fall even further if the South African Reserve Bank (SARB) succeeds in supporting its currency this Thursday. Analysts have noted that risks could push the GBP/ZAR in either direction.

South Africa’s Rand rose against a majority of G20 currencies on Tuesday and pushed the GBP/ZAR lower. The Rand’s recovery follows weeks of losses. Last week the GBP/ZAR rose after fears that the load shedding crisis will deepen.

Loadshedding fears weigh on the ZAR

The South African Rand (ZAR) dropped last week after data showed a rise in unemployment. Released on Tuesday (16 May), the organisation’s Quarterly Labour Force Survey for the first quarter of the year reported that unemployment rose to 32.9% from 32.7% in the previous quarter. Finance, community, social services and agriculture sectors were the main drivers for the employment gains.

According to Reuters, the Rand dropped to a three-year low on Wednesday (10 May), following fears of scheduled blackouts known as loadshedding worsening during winter.

South Africa’s state utility Eskom told parliament on Tuesday (9 May) that there would be a 45-day wait in returning a generating unit online, which could affect the grid during winter, when loadshedding is already more than 10 hours a day across the country.

Unless the energy crisis is resolved, the underperformance will persist, and could lead to a deep undervaluation in the ZAR.

ETM Analytics said that the “SA is in trouble, the grid is under pressure, Eskom does face multiple threats, but none of this is anything new.”

More recently, concerns over the US debt ceiling, have pushed the risk-sensitive Rand lower.

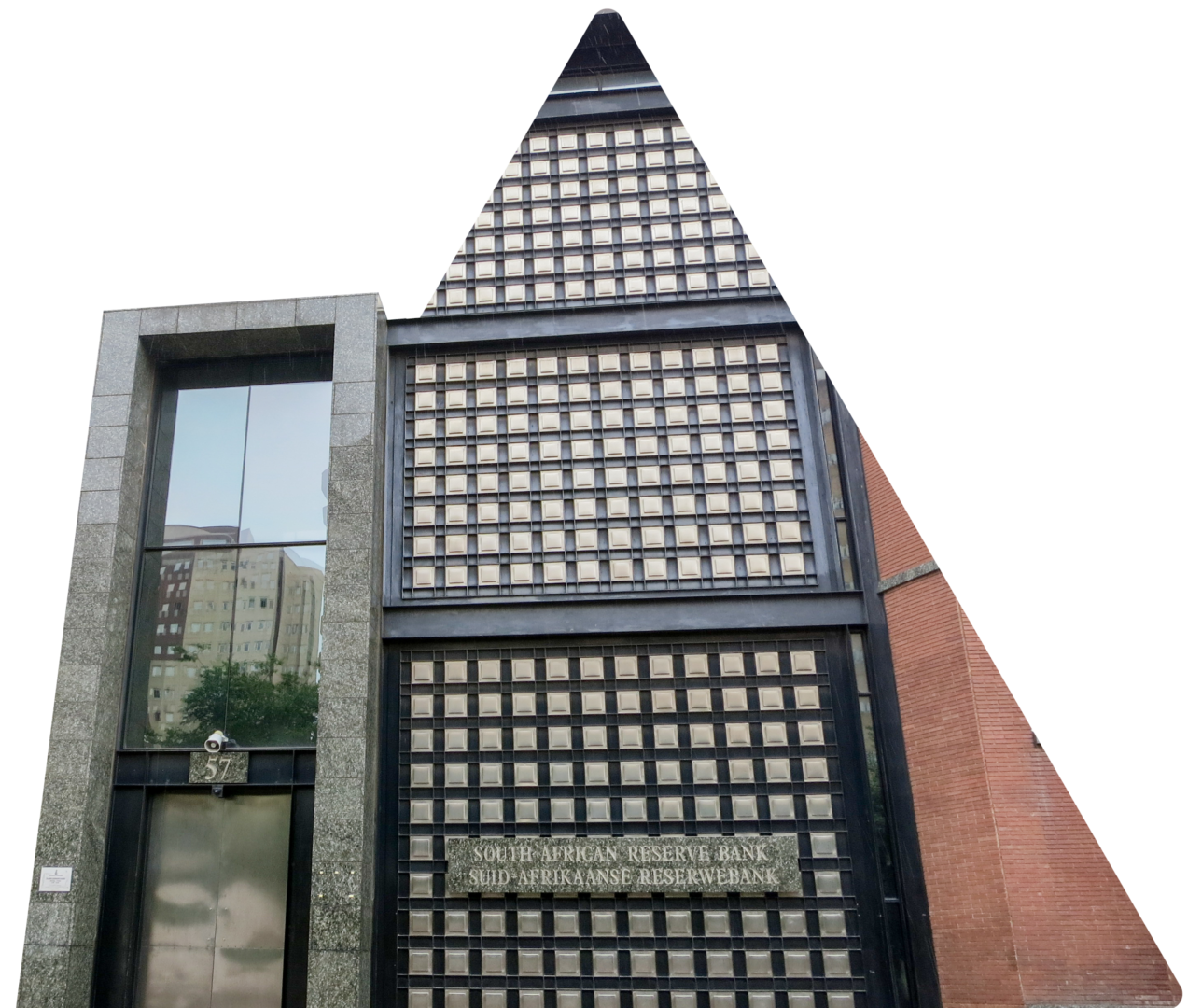

SARB and monetary policy

CEEMEA economist at Goldman Sachs Bojosi Morule expects a 50bp hike from the SARB to a 8.25% terminal policy rate (from +25bp to 8.00% previously). She said that monetary tightening will weaken the economy further and create a feedback loop for the Rand.

Goldman Sachs economists said that recent Rand losses were driven by local investors turning away from the Rand as well as concerns that arms were shipped from South Africa to Russia. Foreign investor sentiment was also negative towards South Africa, due to the electricity outages. Recession fears in the US and the slow recovery of China have also added to global fears.

ZAR could weaken

Today, the South African Reserve Bank (SARB) will set interest rates and if there is any indication of a pause, the ZAR could weaken. The market has priced in a 25 basis-point (bps) increase, but a bigger 50 bps hike is also likely. Anything less than this will weaken the ZAR.

Also, out this week, inflation in South Africa is forecast to cool to 7%, which may add more woes to the Rand.

If further load shedding is possible, then the Rand could weaken. With the blackouts already impacting negatively the South African economy, further outages could push the ZAR lower.